Forex trading strategy #28 (RSI trend - Bollinger dips and rallies)

Submitted by User on January 12, 2010 - 11:18.

NAME: AYETEMIMOWA JAMES FEMI

SITE: www.bondfx.biz

http://bondfx-market.blogspot.com

EMAILS: [email protected]

[email protected]

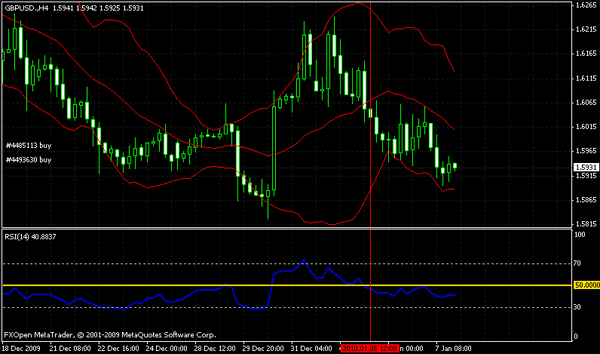

RSI TREND - BOLLINGER DIPS AND RALLIES

The RSI is a quality indicator for trend. I believe this and i am going to explain another profitable way of combining it with the Bollinger Band for good result.

INDICATORS: Relative Strength Index, Bollinger Band (all default Settings)

TIME FRAME: 4HR AND 30MIN (You could also use 30min and 5min)

Its very simple; apply the bollinger band to all time frames but its needed in 30min timeframe. In the 4hr apply the RSI. When RSI is above 50, its uptrend and below 50 is down trend. Then move to 30min for entries.

While in the 30min time frame, in an uptrend, wait for price to close below the lower band of the Bollinger, then a close above the lower band will make your entry for LONG

While in the 30min time frame, in a downtrend, wait for price to close above the upper band of the Bollinger, then a close below the upper band will make your entry for SHORT

Enjoy

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

To the user who made an EA. How is your testing going?

I made an EA out of this due it's very simple to programm. Doing demo test right now. (für the 4h - 30 min) settings

I think this method works for those know how to correlate bollinger and rsi...

It's difficult to judge based on few comments. Try asking the author of the strategy by visiting his website.

Thomas

Are people not using this method any longer??

Is it still profitable?

Hello,

Sorry the link to Thomas Long article here: http://bondfx-trading-plans.blogspot.com/2010/01/multiple-time-frame-ana...

James

Hello,

YOu will be putting your trade at risk alot if u use 30min and 5min so u must have tight stop and good money management. Swing points are good for stoploss and major timeframes can help for stoploss.

To be save, if you are going short, make sure the MACD is above water line in your entry timeframe and opposite for LONG.

The principle of multi-timeframe trading is very important and its the basis for this strategy. Check http://forex-strategies-revealed.com/simple/rsi-trend-bollinger-dips-ral... Thomas Long explained more about this I love it so much and Checn the EUR/USD of today, consolidated up and later went down, if you check the 4hrs and 30min and consider the MACD position. Its cool.

James

James,

Thanks for the system, looks good, will try Monday.

However, can this be traded with any currency, and what do you suggest for stop loss and take profit?

Some of the trades come close to creating a signal regarding closing above or below the bollinger band, but ive noticed a good clue for an entry if this does not happen, could be a Doji/Pin bar or even reversal.. what do you think?

I will be using the 5/30 chart set up London opening.

Once again thanks

This may be a good example too

USDJPY - MAY BE SET FOR A DIP

The daily timeframe closed below the middle bollinger band with the MACD support for a DIP in same timeframe.

4Hr timeframe also helped with more clue with price action at the lower band zone and MACD still pointing down.

30min gave good entry for a short below 91.16 for another 100pips.

Enjoy

James Ayetemimowa

The strategy is very simple and profitable. The backtest shows very promising results. I would like to add the following things if permitted:

The stop-loss should be placed at the high(or low)of the two candles which are used for entry purpose.

The use of 30min-5min combination is very good for scalping consistent pips.

Thank you,

Thank you edward for this. God bless!

Post new comment