Complex trading system #2 (“2-Cross”)

Submitted by Edward Revy on April 19, 2007 - 16:34.

Currency: GBP/USD (preferred) or any other.

Time frame: 3 hours (preferred) or 4 hours.

Indicators:

SMA 200, SMA 100 – these are two influential SMAs; you will find price “obeying” their boundaries.

SMA 15

EMA 5

MACD (12, 26, 9)

Trading Rules:

Since we are dealing with “unpredictable until settled” indicators (EMA, SMA, MACD) we will always be using signals AFTER the current signaling candle is closed.

1. Never open a trade if price is less than 25 pips away from 100 SMA or 200 SMA.

2. Do enter the market when price has crossed either 100 SMA (expect large move) or 200 SMA (expect very large move) and only after the current candle has closed on the opposite side of the SMA. SMAs this big do not get crossed very often.

3. Set stop loss initially at 50 pips. Look for nearest support/resistance level and adjust it accordingly – it could grow up to 70-90 pips but it should not be less than 40 pips. Anyway this measure is taken only to save us from a sudden “exploding market”, in all other cases it will not be hit as our system will take you out from the trade earlier.

4. Enter in the direction of 5 EMA once two conditions are met:

1) 5 EMA crosses 15 SMA “permanently” – which means the current candle is closed and lines are “locked” and will not move while we make a decision to open a trade.

2) MACD lines are crossed, and the current candle is closed.

The 2 crosses do not have to happen simultaneously. MACD lines can cross earlier than EMA and SMA or shortly after, but there should be no more than 5 candles in between 2 crosses.

If “2-cross” condition is not met – no entry.

Exit rules: exit with the same rules as for entry: when two crosses are in place. If we have only one cross – we are still in trade.

Profit target:

a) can be set to a desired amount of pips and followed with trailing stop further once the target is reached.

b) or use 50 pips profit target – do start chasing the price with trailing stop after gaining 50 pips.

c) or you may not use trailing stop and set no profit targets, then exit according to Exit rules – on the next “2-cross”.

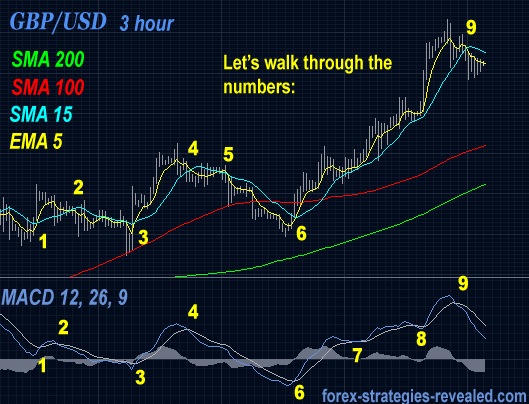

Let’s walk through the numbers:

#1 – EMA 5 crosses 15 SMA, MACD lines also crossed, price is not close to SMA 100 – we place Long order.

#2 – again we have 2 crosses: moving averages cross and MACD – we exit Long and immediately place Short order.

# 3 – 2 crosses are in place, by the time our current signaling candle is closed we are already far enough from 100 SMA, so we close Short and open Long position.

Yes, till this point we were trading in sideways moving market – so no profits here, may be some small negative results. Solution – trading only during active hours, for GBP/USD it is London and New York sessions.

#4 – As we were Long – this point is our exit (“2-cross” condition is met again)

and immediately place Sell order.

#5 – moving averages on the chart have crossed, however MACD – does not, we stay in trade.

We watch price passing 100 SMA and closing below it – it is a good sell signal, but we are already trading it.

#6 – first appears MACD crossover, followed by moving averages crossover – at this point we close our Short position. Do we open Long position immediately? No, because we are very close to 100 SMA. We need to wait until candle passes and closes above 100 SMA to open a Long trade. Once it happens we are in trading Long.

#7 – MACD lines has attempted to cross, but nothing to worry as there is no second cross from moving averages.

#8 – same as #7.

#9 – time to finally close Long position and go Short.

Best of luck in your Forex trading!

Edward Revy,

http://forex-strategies-revealed.com/

Copyright © Forex Strategies Revealed

Very good system....!!!!!! I love it

I just making 100% a week :D

Its okey now, I didn´t see it in text.

Hi Eward,

i want to ask you about Stop losses. Where do you put SL? Or any rules for SL?

And i want to ask you, that i must still watch on the screen and wait for a signal?

Sry for bad eng. and thanks a lot.

Tommy.

I cant see how your making money using the above system, just look at your chart.the 5 and 15 ema are redundent and serv no purpose only to give you whip saw. There is smart money in the market and dumb money. now you can see in your chart where the smart money is and your not entering on it. the smart money only enters when the candle is touching the 200 SMA above for long and opposite for short. 90% of traders loose money becuase of threads like this.

the entry on the 200 SMA is worth more then the pips. so we guard it like gold all the way until to the end,then we convert the gold to cash. As you said there is a large move once price touches the 200 as thats where the money is. on your chart you entered long when price was below the 200, thats against common sence

there are no over trading methods that work. I know this from 8 years trading in the city........MACD is redundent to, RSI Stoch and ADX is all you need.........MACD is redundent

From PaulW

Hi Edward

Another question, as you can tell I am still low on the learning curve.

I noticed with interest that there can be a fairly big difference on where 200MA appears on a chart depending on which types (eg SMA, EMA, LWMA) and which methods ( eg O, C, HHLC/4(I think)) you use. Which standard is the most commonly used one in Fx circles and should be the one to determine where 25pip range?

I also notice that sometimes these levels are completely ignored by the market and the price goes straight through them as if they weren't there. Other times is seems they do act as Support or Resistance lines. Is there something you can direct me towards to help me understand this.

Thanking you and your team in advance

Paul

From PaulW

Hi Edward,

I would appreciate your view on the following 2 observations I have made.

1. Because of work I am not able to devote time to trade 4H so I intend to trade the Daily charts with this system. What words of advice, if any, can you offer me?

2. Secondly, I note that the 100SMA and 200SMA are (obviously) at different levels in the 4H and Daily chart. What should the rule be when the one time frame is saying “go in” and the other is saying “stay out”. Which timeframe wins?

And like so many others I would like to add my voice to that thanks that go your way.

I have not seen your comments on this post of late. I hope you are still mentoring.

Regards

MACD - look for Good_MACD.mq4 - there will be 2 lines.

SMA stand for Simple MA.

Thomas

hi people.

The SMA, is simple or smoothed?

Somebody could help me?

Regards,

´

Daniel

hi all,

I have one question when the cross will be valid ? I can't determine it until now.

thanks

just need to ask about MACD when i use it,it appears as a one line not two lines crossing each other over the trade.

kindly answer me :)

thnxxx

Hi,

I am a professional software developer and have turned my attention to developing EA code.

I would love to work collaboratively with people in the Forex community to help to develop a good solid EA code. I am interested in this strategy of 2-crosses but will willingly work on any others to develop an EA that is successful. I think collaborative working within a community can provide a great way to develop a working system. More heads the better on 'testing-refining-testing' until it works.

I have taken this 2-cross strategy as a starting point. I have built that into an EA but back testing results for 2011 on the GBPUSD on a 4 hour chart (using MT4/Alpari) don't give good results.

Anyone want to start to help me through backtesting/refine/retest and join my on my journey?

Many thanks

Tim

I hope this post arrives on time to the forum and some of you read it and take profit of it:::

There is about to occur again a "double cross" configuration on the USD/CHF (9/5 @18:00 EST). Last one I made 148 pips (I could have made 280+ but I was greedy and newbie... See my previous post)!

I'll keep you informed.

Hello All... And thx a lot for all you do for us Edward!

I'm new at FOREX (less than 2 months trading) and I have tried some strategies here and ther with terrible results. I won 100 pips "riding the 20 SMA" and after that the road has been going down and down and down...

But then... I found this "2-Cross" strategie and I did some research and tests and stuff until last night () that I found the 2-Cross was about to happen on the 4 HRS USD/CHF. I entered the next candle after the crosses (@0.8127 5 something am) with TP and SL 50 pips awayand went to sleep... I hit the TP less than an hour later! I panicked!!! Now what????

After some 6 am mistakes with the Trail Stop margins (I was greedy and was kicked out the trade twice!!! loosing 25 pips each time!). I started the trade again as if it was the first time... and BANG!!! 60 more pips. Entered once more time.. I'm winning 20 more pips and trade is still running (8/31 1:36 pm).

So... Edward. First of all... Thx for sharing all these strategies for free.

What is your recomendation for the Trailing Stop's margin? Do you use the same 50 pips?

Ohh... I'm also using ADX to check the Trade... (it is 35 right now)

I'll keep you posted about test results... (Is always nice to know how people is doing with a specific strategy)

Regards

Enzo!

this method is working very well for me. using same parameters, i'm using it on GJ One hour . my stop loss is usually 25-35 pips but i always move the stop loss to break even when the trade is at around +10 pips.

thank you very much Mr Edward for sharing this great system

Gizaiga.

Post new comment